How much do people spend online? According to Statista, the overall payment volume in digital transactions is expected to reach $20.37 trillion in 2025.

The major motivators behind this growth are convenience, ease of use, and diverse software solutions that allow users to make frictionless operations with one click of a finger.

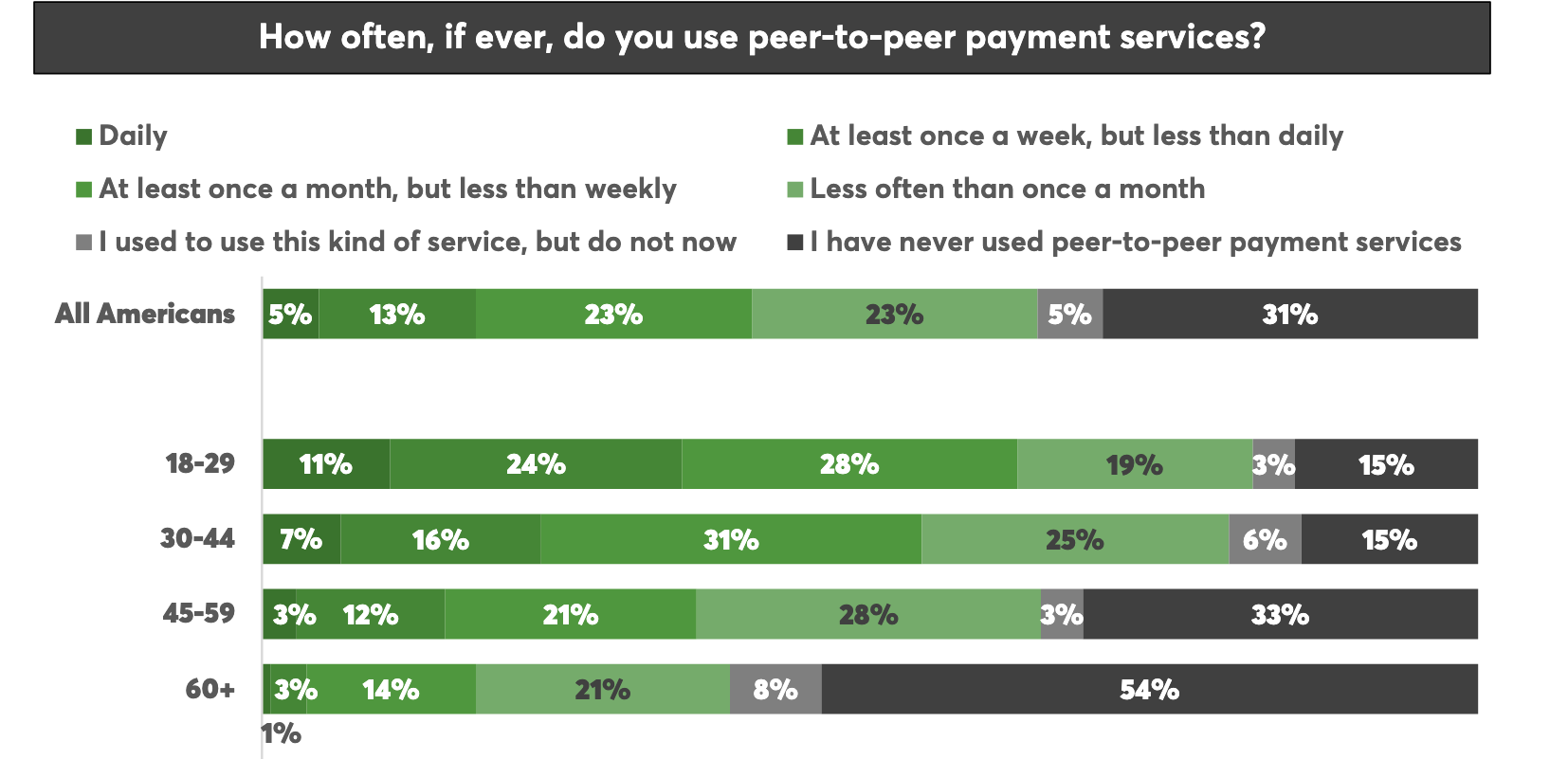

A significant part of all operations in the financial sector is made up of P2P (peer-to-peer) payments. For example, in the US more than 50% of users that consume financial services send money via P2P, while in Brazil this number is close to 82%.

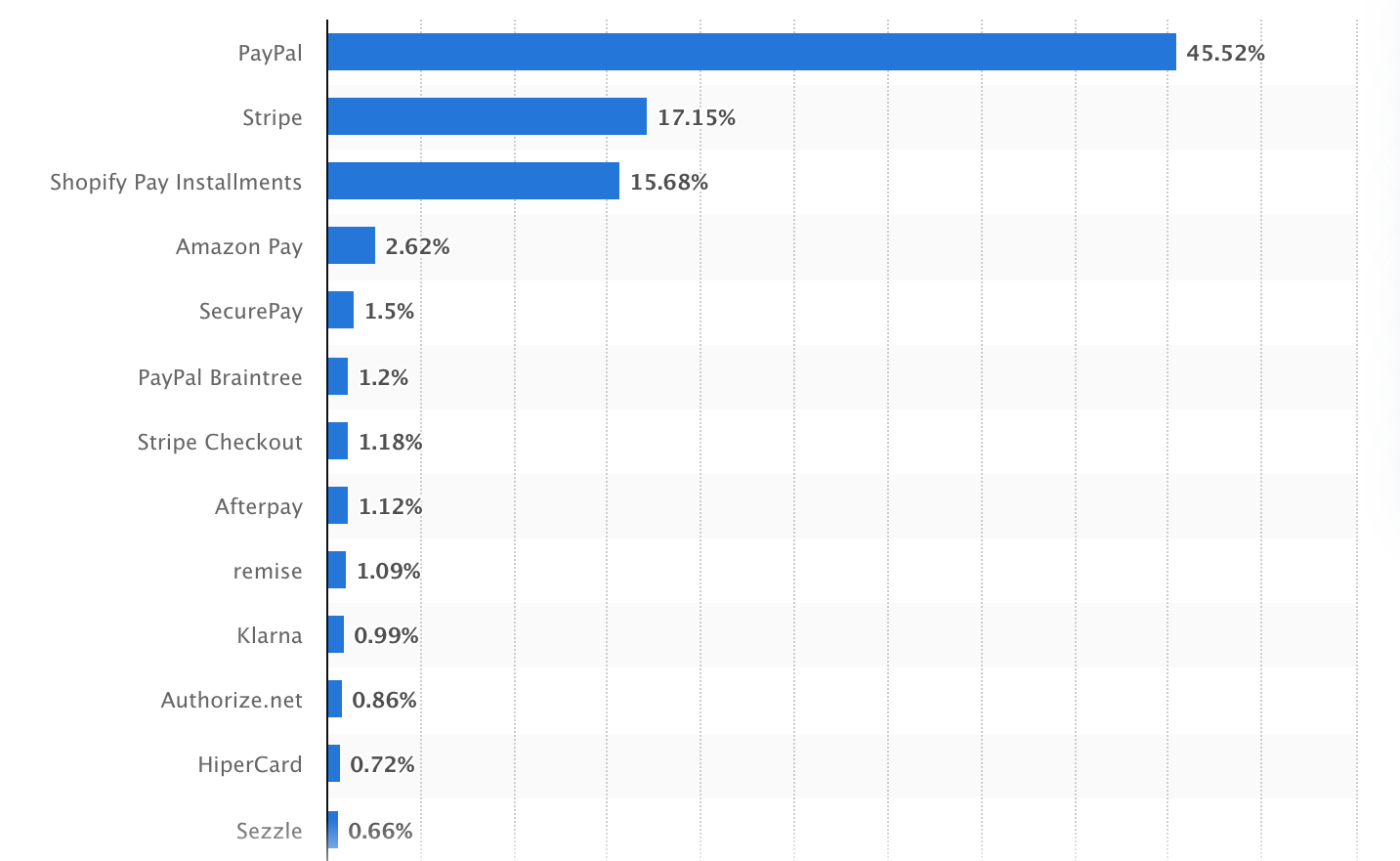

Another confirming factor is the popularity of such platforms as PayPal which is predicted to be the quickest-growing way to pay throughout the world.

Most used payment processing technology, Statista

Digital wallet transactions in e-commerce, for example, are expected to grow at a solid 15% per year from 2023 to 2027.

Taking all of this into account, it’s become clear that developing a P2P payment app appears to be a worthwhile venture with decent monetization options.

This guide walks you through everything you need to know about custom mobile app development to get a successful P2P payment app.

What Is a Peer-to-Peer (P2P) Payment App?

A P2P payment application is a software tool that allows people to transfer money to other persons directly without banking intermediaries. P2P transfers, in turn, may refer to splitting bills with friends or colleagues, paying rent, or even shopping on the Internet.

How Do P2P Payment Apps Work?

P2P payment applications work via virtual wallets, which are linked to a user’s bank account, debit card, or credit payment card.

A user initiates the transfer, the application processes the payment and verifies the transaction before the funds show up in the recipient’s account. Some P2P apps use blockchain, and others are based on traditional banking infrastructure.

Statistics on the use of P2P payment systems among Americans, Consumer Reports

Types of P2P Payment Apps

Not all P2P payment apps are created equal—some pull money directly from your bank, others act like digital wallets, and some even use cryptocurrency.

If you plan to build one, you should know the different types so that you may select the right course.

Bank-Centric P2P Payment Apps: Prompt and Direct

Because these apps work directly with your bank, there’s no need to load money into a separate wallet: when you send cash, it moves straight from one bank account to another, usually in seconds.

Bank-centric apps are normally backed by large financial institutions, this way such applications are perfect for people who want a no-frills, simple money transfer without extra details getting in the way.

Standalone Digital Wallets: More Than Just Money Movements

Instead of transmitting money straight from your bank, these apps act as digital wallets where you can hold your capital, make payments, and even do online shopping.

Standalone digital wallets often have lots of extra perks: for example, Venmo lets users add emojis and make captions to payments, Cash App offers a debit card, and PayPal is widely used for online purchases and business transactions.

Mobile Wallets with P2P Features: All-in-One Service

You may already have an idea about how great a wallet app is to make contactless payments in-store at checkout.

But they also allow you to send money right from your phone to friends and family. Because these apps are integrated into the ecosystem of your device, you can also enjoy added safety features, such as Face ID or fingerprint scanning.

Crypto-Based Peer-to-Peer App: The Future of Money

For those who prefer virtual currencies over classic banking, Binance Pay, BitPay, and Coinbase Wallet make a perfect alternative.

Crypto transactions are considered faster and cheaper, especially for international money transfers. Of course, they have some risks, such as price volatility, but some applications embed stablecoins, which hold value more consistently.

By and large, these applications are perfect for crypto fans and any individual interested in seeking out decentralized financial solutions.

Cross-Border Payment Solutions: Built for International Transfers

The very good thing about cross-border payment apps is the convenience of transferring money internationally without paying ridiculous fees.

They enable you to move cash across borders at lower costs than banks can and even hold multiple currencies in your account.

Usually, these tools are popular among freelancers, businesses, and frequent travelers who deal with different currencies all the time.

Advantages of Making Your Own Peer-to-Peer Payment App

If you’ve ever thought about making your own P2P payment app, you’re on the right track.

Rather than depending on services like PayPal or Venmo that everyone can download from the app store, having your own app means you get full autonomy over every part of the application.

First of all, when you make your own payment tool, you’re not stuck with the limitations of existing platforms. Want instant transfers? Multi-currency support? Maybe even crypto payments?

You can add whatever features that make sense for your users. Unlike third-party providers, where you must work around their terms, P2P app development gives you the free will to create the experience you want.

Of course, an important aspect is money. Using market software often means paying more every time funds move. That might not seem like too much at first, but those fees add up—especially for businesses directing a lot of operations.

With your own app, you fully regulate the pricing. You can lower fees to entice more users, offer premium elements, add some exclusive means to monetize transactions, integrate advertising, or even add cashback rewards—whatever works best for your audience.

Another aspect is security. When you own the platform, you decide how secure it is. You can integrate encryption, biometric authentication, and fraud detection to prove transactions are safe.

Plus, you stay in control of regulatory compliance, meaning you can construct a trustworthy app that adheres to PCI DSS, GDPR, and KYC/AML without leaning on third-party policies.

Lastly comes scalability. You can expand to new markets, support new forms of payment, or even integrate AI-powered fraud detection.

How to Monetize a P2P Payment Service

Surprisingly enough, turning your P2P mobile payment application into a money-making machine can be easier than you imagine. Options are enormous, and the final choice depends only on which kind of components to implement and under which scheme to put your project.

Transaction Fees

The simplest way of bringing in profits would be to charge transaction fees in the form of a small percentage or a flat fee per transfer.

For instance, Cash App charges instant payment processing fees or if you send money using a credit card. Even though this method gives you a regular income, you shouldn’t demand unreasonable fees so as not to scare subscribers away.

Premium Features

Another option is to sell a pro version or paid membership. Users can pay for faster transfers, higher limits, or access to premier extras, such as financial tools or better security.

Premium features are completely worth it, but at the same time, they don’t oblige users to anything. They can just stay with the free version or pay some money to get some supplementary benefits.

Interest on Balances

If your app lets users store money in their accounts, you can earn it by investing their balances or teaming up with financial institutions to offer interest on their funds.

PayPal does something similar by using the money in users’ accounts to earn interest, which can generate passive income for you while still permitting users to make use of their funds when needed.

In-App Advertising

If you’ve got an unchanging user base, you can make money through in-app ads. This could be anything from sponsored content to partner offerings.

The main problem here is not to overflood your users with too many promotions. You could also suggest an ad-free option for a small fee, which would let users reject ads.

Partnering with Merchants

The fifth way to monetize is by partnering with other businesses and merchants. You can take a small commission from businesses with every transaction or give them an opportunity to advertise or promote their services within your app.

Some apps (e.g., Cash App) offer rewards in the form of cashback when consumers shop at specific retailers. All in all, it’s a win-win situation, as it forces app usage and brings in funds.

Cross-Border Payments

You can also charge fees for sending money abroad if your app allows for international payments.

Cross-border usually involves higher fees due to currency exchanges and additional regulations, so it’s a great way to make money by satisfying the needs of users needing to send money to the other end of the planet.

Data Analytics & Insights

If you amass particular data records (with user consent, of course), you can provide paid data analytics for subscribers.

For example, you can sell insights into consumer shopping patterns and spending trends, but cautiously and in a manner that doesn’t violate user privacy.

Peer-to-Peer Lending

Via peer-to-peer lending, users can give and take money from each other. From the monetization side, a money-lending app or the app with the lending functionality can take small fees, cut off the interest, or offer added financial services.

Essential Features of Your P2P Payment App

Owning a P2P payment app goes far above letting people send and accept funds. If you want your software to get noticed, we suggest you add the following parts:

- Instant & Invulnerable Money Transfers: The entire point of a successful app is to transmit and accept money in no time. No matter if users pay friends, family, or businesses, transactions should happen with no waiting or as close to it as possible.

- Multi-Payment Options: People never bank in the same way, so your application should offer multiple means to pay. Linking bank accounts, debit and credit cards, digital wallets, and even crypto will be great in this direction.

- Contact Syncing & QR Code Payments: Nobody wants to type in long account numbers when sending money. This way, your application should auto-sync with the user’s contacts to allow them to send payments with just a phone number or email. Incorporating QR code payments can add to convenience—users can scan and pay, whether they’re splitting a bill at dinner or paying a small business.

- Transaction History & Receipts: Users need to watch their spending within the app; hence, a crystal clear and organized transaction history is what they require. Show details such as the amount paid, recipient, date, and status—pending, completed, or failed.

- Payment Splitting & Request Features: One of the best features of payment apps is how easily they let one split bills. Be it rent, dinner, or a group gift, users should be able to split up payments and request money from multiple people in just a few taps.

- Notifications & Alerts: Users should never have to guess if the transaction was completed. Push notifications and SMS/email alerts will always keep them up-to-date on transactions, payment requests, or security changes.

- Multi-Currency & Cross-Border Payments: If you want to give your app the power to reach farther, provide multiple currencies, international transfers, integration with foreign exchange services, and live conversion rates so users know exactly how much they send and receive.

- Rewards, Cashback & Loyalty Programs: A little incentive goes a long way. Different incentives, such as cashback, discounts, or rewards for frequent users, will persuade more and more people to favor your app above others. One of the finest ways to distinguish your app out in the market chaos is by showing your users appreciation.

How to Create a P2P Payment App

Building a P2P payment application is actually not about writing code but rather creating an appropriate experience to please people. Right from the feature selection to security, a lot goes into making an application successful.

Think Who You’re Constructing Your Online Payment App for

Before plunging into money transfer app development, step back and ask yourself—who’s gonna use your app? Is it going to be for a friend to split bills with, or for small businesses getting QuickPay or freelancers who get paid?

Knowing the people you’re reaching helps you shape the right feature set and overall direction.

Plan the Obligatory Features

Now let’s go into features. At the minimum, your app must include money transfers, several payment options, and transaction history. If you want to be different, add engaging extras: QR code payments, bill splitting, multi-currency support, and cashback rewards. Think of what will make sense for your users and build from there.

Work with a Reliable Development Partner

Let’s get real—no P2P payment application will ever get off the ground without proper expertise. You need a strong tech foundation, airtight security, and a killer user experience.

That is why it will make all the difference if you partner with a professional software development team to create a money transfer app. A good partner for development will help you:

- Pick up the correct technology stack—either Flutter or React Native—to build an awesome application.

- Implement sufficient security mechanisms: encryption, tokenization, and two-factor authentication.

- Create a user-oriented interface.

- Integrate with payment gateways for flawless transactions.

Rather than trying to make everything on your own, working with the right team guarantees your app is made the right way from the beginning.

Test, Amend, and Test Again

Deep testing of the application must be done before its launch. Functional testing confirms that everything works as demanded, security testing finds vulnerabilities, and user testing provides feedback under lifelike conditions.

The beta launch among a small group of users will iron out the last-minute bugs before the major release. Skipping this step? Bad idea—it may lead to security problems or frustrating users.

Stay on the Right Side of the Legislation

Since you are handling people’s money, legal compliance becomes an obligation. You will have to make sure that your app conforms to such regulations as PCI DSS for secure payments, GDPR for data protection, and KYC/AML to prevent fraud.

Launch & Promote

When all is ready, now’s the time to go live. Don’t just release an app and hope things go well; promote it. Use social media, influencers, and referral bonuses to onboard users. A well-thought-out marketing program can make your app grow like crazy in no time.

Keep Refining Based on User Suggestions

Your work isn’t done once the app is live. Monitor user feedback, watch how people use your app, and roll out updates to resolve issues and make improvements. The best apps constantly develop depending on what their supporters want.

Main Roadblocks in Developing a P2P Payment App

That sounds like an incredible idea for a P2P payment application: fast money transfers, easy monetization, and a growing user base.

Behind the scenes, however, it is not that simple. From security and regulations down to guaranteeing that each and every transaction goes through, there are a lot of obstacles involved.

First of all, security. Anytime money is involved, hackers and scammers are right there looking for a way in. Therefore, your app needs to have all security measures ever possible: encryption, two-factor authentication (2FA), and fraud detection.

If users don’t feel safe using your app, they won’t stick around. That means clear protection policies, scam awareness components, and your personal guarantee as an owner that money is protected at all times.

Then comes regulatory compliance. Depending on where your app operates, you’ll have to follow strict financial regulations, such as PCI DSS (for unassailable card payments), KYC/AML (to verify users and control fraud), and GDPR (to safeguard user details).

Remember compliance measures aren’t just suggestions—ignoring them could get you fined or even banned from certain regions. So adhering to these regulations is a pure must.

Even with impeccable security and compliance, it can be a problem to provide flawless payment processing.

Users presume that money shall be transferred on the spot in real life; in reality, it may still get delayed depending on how the banking systems are working, server downtimes, and network issues, amongst others.

Your app also has to support a slew of payment systems: bank transfers, debit cards, credit cards, e-wallets, virtual assets, etc. When the transactions fail or take longer, users get frustrated and switch to other applications.

The other big challenge is gaining the users’ trust: if people are not 100% sure about your application, they won’t use it for something as important as money.

Unambiguous onboarding, lucid transaction policy, and buyer/seller protection will go a long way in gaining user confidence. At the same time, an easy way to dispute the transactions or request refunds whenever something goes wrong makes quite a difference.

If you’re planning to support cross-border operations, things get even more problematic. Governing different currencies, exchange rates, and international transaction fees requires extra planning.

Plus, some countries (e.g., the UK) have strict regulations around digital payments, so you’ll need to consult with financial partners who can help sort through the complexities.

Also, the more users use your application, the higher the scalability issue you face. Users will begin facing slow transactions, app freezing, or even failed payments if your system is not strong enough to hold high traffic.

Investing in a cloud-based infrastructure and making your app extendable can help prevent that from happening ahead of time.

Finally, don’t forget about customer support. No matter how well you make your app, things sometimes go wrong—whether it’s a failed payment, an unauthorized charge, or a refund request.

Users always need quick and helpful support. If they can’t get help fast, they’re not going to stick around.

Popular P2P Payment Apps You Can Use as a Reference

Despite the fact that there are already quite a few similar solutions in the P2P payment market, you shouldn’t be afraid of competition. On the contrary, existing options can be used as a reference, and based on them, you can create a payment app of your own.

PayPal: The OG of Online Payments

PayPal has been on the market for quite some time (well, since 1998), and it’s still one of the most trusted means for sending and receiving money all over the world, paying for online shopping, freelancing, and making business transactions.

What makes it great?

- Works in tons of countries and supports many currencies.

- Lets you sync bank accounts, credit cards, and PayPal balances for convenient transfers.

- Provides buyer and seller protection, so you don’t get scammed on purchases.

- Business-friendly with invoicing, subscriptions, and payment processing.

Venmo: The Social Payment App

If you’ve ever noticed someone post “just paid for brunch” on their feed, chances are they’re using Venmo. Although Venmo is owned by PayPal, this online digital banking platform differs from its parent due to its social sharing feature.

Why people love Venmo:

- Lets you add emojis, GIFs, and captions to payments.

- Offers instant transfers and direct deposit options.

- Venmo debit card lets you spend your balance anywhere.

- Works with online sellers, so you can pay for any items.

Cash App: More Than Just Money Transfers

Cash App from Block, Inc. (previously Square) does more than just payments. You can send money, receive money, invest in stocks, trade Bitcoin, and even spend the balance by ordering a personalized Cash Card.

What’s great about Cash App?

- Instant money transfers with no hidden fees.

- An option to buy and sell Bitcoin right in the app.

- Cash Card linked to your Cash App balance.

- Direct deposit feature so you can get your paycheck straight in the app.

Zelle: The Bank-Backed Instant Transfer Tool

Zelle is a little different from other tools—it’s built into most banking applications and lets you send money straight from one bank account to another in seconds. No need for extra wallets or accounts.

Why it’s a good alternative:

- No extra app is required if your bank supports Zelle.

- No transfer fees (yep, free instant transfers).

- Higher transaction limits compared to most P2P apps.

- Truly fast—money lands in the recipient’s account within minutes.

Google Pay & Apple Pay: Mobile Wallets with P2P Bonuses

Google Pay and Apple Pay began as contactless payment systems, but they also allow people to send money to friends and family. If you’re deep in either the Apple or Google ecosystem, this functionality is extremely convenient.

What makes them reasonable?

- Tap-to-pay at stores and online.

- No transaction fees for P2P transfers.

- Extra security with biometrics (Face ID, fingerprint scanning, etc.).

- Works with other Google and Apple services.

Revolut: The Fintech Titan

But Revolut is way more than just a P2P payment app; it’s like an entire financial hub where you can send money, exchange currencies, trade stocks and crypto, and even set up budgeting tools.

Why people value Revolut:

- Supports multiple currencies, great for travelers.

- Instant transfers between Revolut users.

- Lets you trade stocks and cryptocurrencies.

- Has budgeting and analytics tools to regulate spending.

WeChat Pay & Alipay: China’s Superb Apps

In China, WeChat Pay and Alipay dominate the P2P payment direction. They’re integrated into everyday life, from paying for groceries to hailing taxis and booking flights—all with a simple QR code scan.

Why they monopolize in China:

- QR code payments for everything, from street sellers to luxury stores.

- Deep integration with companies, online shopping, and ride-sharing apps.

- Supports bill payments, insurance, and investment options.

- Safe and has AI-driven fraud prevention.

Best Practices in Developing a P2P Payment App

As we mentioned earlier, building a P2P payment app goes far above letting people send funds.

With industry titans like Venmo, PayPal, and Cash App already on the market, your app needs to have something truly exclusive to grab a share. So, what does it take to build a P2P payment app that people actually want to use?

First of all, security must be impenetrable. Since your app will manipulate real money, it becomes a tempting target for hackers and scammers. Make sure you have all means possible, such as end-to-end encryption, two-factor authentication (2FA), and fraud detection.

Adding biometric login options, for example, fingerprint or face recognition, can also reinforce security without making it harder for users to log in. Note that if people don’t trust your software, they will never use it.

Next come transactions that must be fast and hassle-free. No one wants to wait around for their money to go through. Your app should be made for live payments, with a strong backend that ensures flawless processing.

If people have to struggle to clarify how to send money, they’ll just switch to another app. Therefore, a clean, uncomplicated interface, instinctive navigation, and a quick transaction process are non-negotiable.

Of course, abiding by the law is also a must. Many countries have uncompromising financial regulations, and failing to follow them can lead to severe fines, license revocation, or even long-term bans.

Users should also have an effortless channel to report scams, and a bit of education on how to spot fraud can go a long way in keeping their accounts safe.

No matter how superior your app may be, sometimes things go wrong. In-app chat support, AI chatbots, and a well-organized FAQ section will help keep frustration levels low and make users feel they have nothing to worry about.

If you feel nervous about future growth, take into account cloud-based infrastructure and optimized databases to keep everything running evenly, no matter how much traffic your app gets. Planning for growth from the start will save you from major tech headaches down the road.

Before launching, test everything—multiple times. You’ll want to run functional tests to confirm all features work, security tests to detect vulnerabilities, and user tests to polish the experience.

A beta launch with a small group of users can also help uncover any last-minute bugs or pain points before the full rollout. The more you check, the fewer unforeseen issues you’ll have when your app goes live.

And finally, stay alert. The fintech industry moves fast, and if you don’t stay on pace, you’ll lag behind. Regular roll-out updates with fresh features and performance modifications to remain competitive.

Cost of Developing a P2P Payment App

Building a P2P payment app can cost anywhere from $50,000 to $500,000 or more, depending on how complex you want it to be. The more features you add, like instant payments, fraud protection, or multi-currency support, the higher the price will go. On average:

- Basic MVP – $30,000–$50,000

- Feature-Rich App – $70,000–$150,000+

- Enterprise-Level App – $200,000+

Whether you go for iOS, Android, or both platforms, and whether you hire freelancers, an in-house team, or outsource development also affects the final cost.

The development process normally includes elaborating the design, building the backend, developing the mobile app features, and proving everything works appropriately with plenty of testing.

Don’t forget about hidden costs, such as cloud hosting, payment gateway fees, and compliance consultations.

A good way to save money is by starting with an MVP (Minimum Viable Product) to test the app’s viability and add more features over time if the platform comes out on top. Outsourcing development and using existing payment APIs can help you slash costs without sacrificing quality.

Why Choose Us for Your P2P Payment App Development?

Overall, the SCAND team has over 20 years of experience in software development. With deep expertise in fintech and blockchain development, we provide first-class expertise to create safe, feature-packed, and convenient P2P payment applications.

Our team ensures adherence to all financial regulations and the implementation of advanced technologies for flawless and high-performance software tools.

Whether you need a custom app from scratch or just enhancements to an existing system, we provide end-to-end development services adjusted to your plans and aspirations.

Frequently Asked Questions (FAQs)

What is a peer-to-peer mobile payment app?

A P2P payment app lets people send and receive money directly—no middleman needed. P2P apps can be used to split a bill, pay a friend back, or shop online.

How do I start developing P2P payment software?

First, do your homework—research the market, figure out what features users seek or lack, and specify what will make your app stand out. Next, choose a team up with experienced app developers to build the app of your dreams.

How much does it cost to build a custom P2P payment app?

It depends on what you want your app to do. A simple version (MVP) could cost around $30,000, while a fully loaded app with top-tier security and extra features could run over $200,000. By and large, it depends on integrations, compliance, and custom features.

How can I make my P2P payment differ from others?

There are tons of apps on the market, so you’ll need some exclusive attributes. It can be crypto transfers, AI-powered spending insights, or international payments.

What are the main obstacles in P2P payment app development?

Building a payment app isn’t just about coding—it’s about security, compliance, and making sure everything runs without a hitch. Fraud prevention, regulatory approvals, and integrating with different payment providers can get tricky. That’s why working with experienced fintech developers makes a huge difference.

How does a P2P money transfer app make money?

There are a bunch of means to monetize a payment app. You can charge small transaction fees, offer premium features like instant transfers, create subscription plans, partner with merchants, or even add crypto trading options.

Do I need to worry about compliance and regulations?

Yes—fintech apps have to follow strict regulations regarding PCI DSS, GDPR, and AML (Anti-Money Laundering). Ignoring these can lead to immense fines or even getting banned from operating in certain areas.

How long does it take to make a P2P payment tool?

A basic app can take around 3-6 months, while a more advanced one with extra features and AI fraud detection might take 12 months or more. It all depends on the complexity, testing, compliance approvals, and user feedback.

What payment methods can I integrate?

You can support all kinds of payments, whatever suits your clients—credit/debit cards, bank transfers, digital wallets (Google Pay, Apple Pay), cryptocurrencies, and even QR code payments.

Why should I work with a development partner instead of building it myself?

Unless you have an in-house team of fintech experts, outsourcing to a skilled development team is usually the best move. They’ll direct protection, compliance, UI/UX, and extendability so you don’t have to stress over the technical side.